Hope many of you folks might come across series of market falls. Did you ever thought about how to earn there any way I can gain money in this fall day or loss day. If you haven’t thought yet, nothing is late than never, there are ways where in you can gain on falling days. If you are good at predicting next day market, then there is smarter way to earn money in Dalal Street.

Options trading are of 2 types

1. Call Options.

2. Put Options.

Like Equity market price, Call Options premium rates are directly proportional to market rise or any particular stock rise. If you can predict market rise then go for Call Options where in your ROI increases when market increases.

Put Options are means to earn money when market falls. PUT options premium rates increases when market index falls, similarly if market index rises PUT options premium decreases. ROI is inversely proportional to Market Rise or stock price rise.

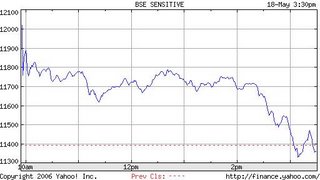

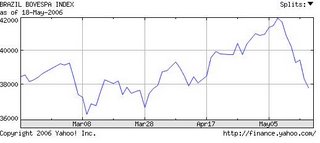

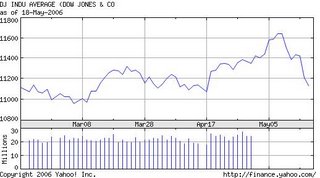

Yesterday I did my first Put Options trading. I predicted that market will fall yesterday due to momentary global down trend. I bought some PUT options during the day opening and sold the same within the same day. I got 30% ROI in just 2 hours....that too when market witnessing huge fall. Isn't exciting! Options Way to go baby!

Buy CALL Options if you are good at predicting future’s market rise or Buy PUT Options if you are good at predicting future market fall.

Combination of placing and holding CALL & PUT options is termed as HEDGING. Always having combination of the both the options is smarter way to trader.

Happy Investing!

1. Call Options.

2. Put Options.

Like Equity market price, Call Options premium rates are directly proportional to market rise or any particular stock rise. If you can predict market rise then go for Call Options where in your ROI increases when market increases.

Put Options are means to earn money when market falls. PUT options premium rates increases when market index falls, similarly if market index rises PUT options premium decreases. ROI is inversely proportional to Market Rise or stock price rise.

Yesterday I did my first Put Options trading. I predicted that market will fall yesterday due to momentary global down trend. I bought some PUT options during the day opening and sold the same within the same day. I got 30% ROI in just 2 hours....that too when market witnessing huge fall. Isn't exciting! Options Way to go baby!

Buy CALL Options if you are good at predicting future’s market rise or Buy PUT Options if you are good at predicting future market fall.

Combination of placing and holding CALL & PUT options is termed as HEDGING. Always having combination of the both the options is smarter way to trader.

Happy Investing!

JAPAN NIKKEI

JAPAN NIKKEI